A report by Accenture revealed that financial services witnessed 270 attacks focused on unauthorized access of data or networks, a rise of more than 30% as opposed to 2022.

The rising number of money-centric cyber threats has forced organizations to seek trained information security professionals. Cybersecurity is vital because it helps protect the sensitive accounting information of users.

In this guide, you’ll learn the importance of cybersecurity in accounting, its key measures, threats, real-world examples, and best practices to safeguard financial data in this digitized world.

Quick Navigation

Role of Cybersecurity in Accounting

We live in a world that is for technology, by technology, and of technology. Thanks to digitalization, most of the financial data is now electronic, and thus easier to manage.

But this industrial shift has also given rise to new means of infiltrating security infrastructures. Accounting data has especially emerged to be a soft target for cybercriminals.

The reason is simple – “This is where all the money lies.”

The Financial Services Information Sharing and Analysis Centre (FS-ISAC) stated in its 2022 report that the growing adoption of banking apps and web portals has exponentially increased the risk of compromising banking systems.

Adopting the most advanced cybersecurity measures has become more important than ever because it helps:

1. Protection of Sensitive Client Information

Software security helps accounting institutions secure the database of existing users. Measures like network security surveillance further allow them to continuously check for viruses and other intrusions, thus protecting sensitive client information.

2. Reduce Unauthorized Access

OTPs, passwords, debit/ credit card information or social security numbers (SSN) are some of the most stolen accounting data. Cybersecurity prevents external penetration whenever such information is transmitted online.

3. Mitigation of Data Loss

By employing cybersecurity technologies, a company prevents mitigation of data loss in case of cyber thefts. Monitoring data loss and filtering network channels play a vital role in protecting financial data and ensuring authorized data access.

4. Maintain Business Continuity

Cyber attacks can pose major problems for businesses including financial loss, damaged reputation, and loss of clients. Many times the repercussions can be so massive that the firm has no option but to shut down. MedStar Health is one of the most popular companies that went out of business due to hackers. Cybersecurity helps in minimizing the impact of cyber attacks.

Relevant resources:

- Cybersecurity vs Computer Science: Key differences

- Differences between ethical hacking and cyber security

- Different cybersecurity domains

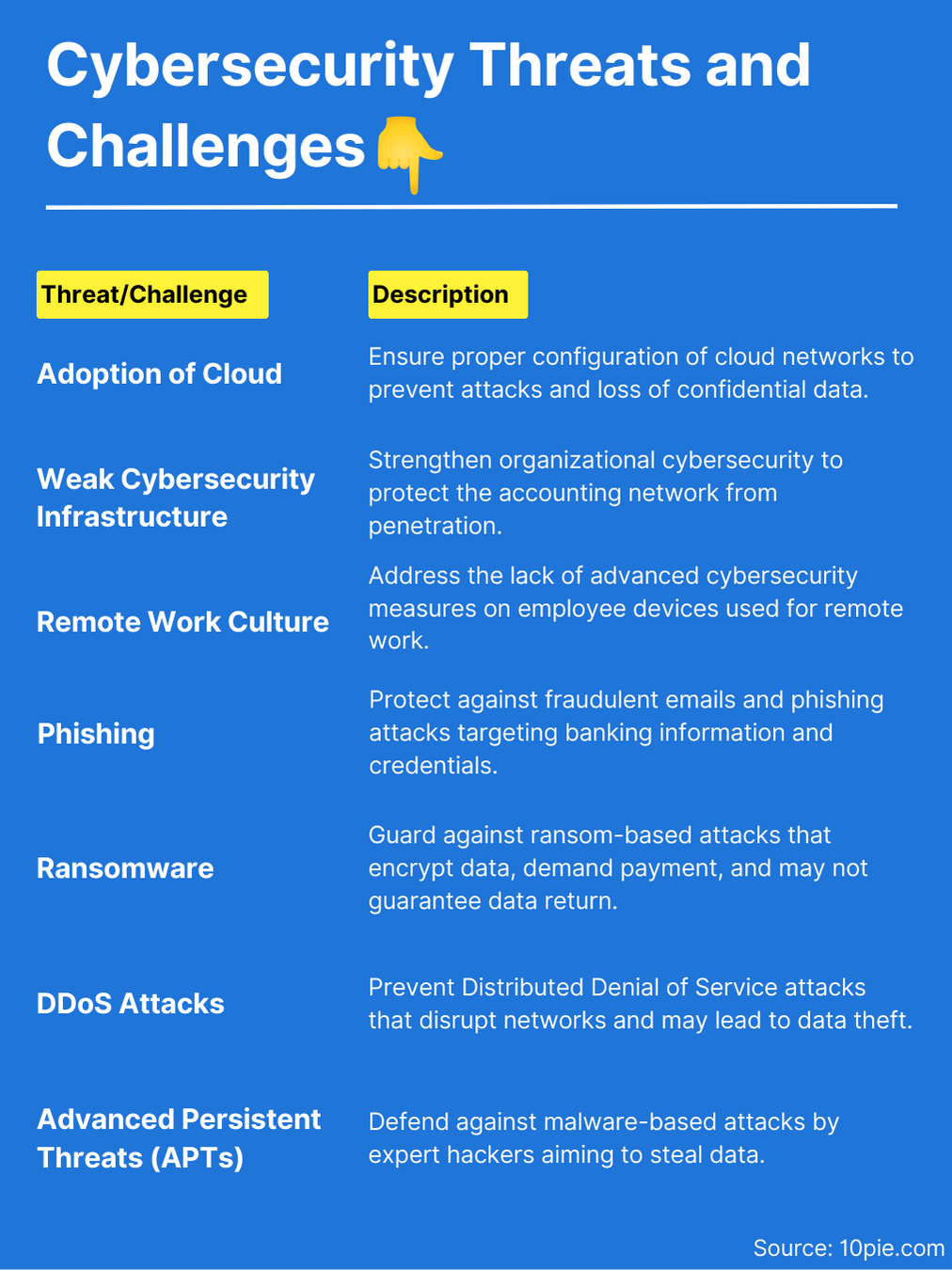

Cybersecurity Threats and Challenges For Accounting Firms

As per IBM, the average cost of data breaches in the financial services sector is evaluated at USD 5.72 million per incident in 2023.

Understanding organizational challenges is necessary to create solutions that prevent cyber incidents from becoming full-fledged attacks.

Here are some of the biggest cybersecurity threats and challenges in the modern accounting landscape:

1. Adoption of Cloud

Cloud has taken all industries by storm, and accounting is no different. Cloud computing has been highly cost-effective for businesses as it manages client data and interactions in a central location.

However, if not configured appropriately, cloud networks are easy to attack. This implies the loss of confidential financial information and records.

2. Weak Cybersecurity Infrastructure

Hackers these days have been able to penetrate organizational structures with little training and sophistication.

A weak cybersecurity architecture means jeopardizing the entire accounting network of a company. It is crucial that all organizations follow the data protection and cybersecurity guidelines provided by the government.

3. Remote Work Culture

The COVID-19 outbreak allowed many organizations to operate on remote and hybrid models. This continues even after the pandemic is over. Just like others, financial professionals have also taken on this culture.

However, the issue is most of the employees who work from home do not have advanced cybersecurity measures installed on their devices. These open ends can lead intruders to the organization’s financial database.

4. Phishing

Phishing attacks fraudulent emails that once clicked lead to the hacker’s website. The attachments and links in the mail are convincing enough to make the victim believe that they are from banking institutions.

Along with this, another type of phishing attack includes sending out messages and calls to get updates on OTP and pin-related information. It remains one of the biggest cybercrimes in the accounting sector.

Learn more about different types of cybersecurity attacks:

5. Ransomware

Ransomware as the name suggests is a ransom-based cyberattack. It involves malware that is developed to encrypt data. If the criminals are successful in their attempts, they ask for a hefty amount in place of the decryption key.

The attack is nothing less than a trap. Even if the organization pays the ransom money, there is no guarantee of getting the data back. These attacks have dire consequences for the accounting industry.

According to VMWare, 75% of the leaders in the financial sector security domain experienced one or more ransomware attacks in 2023, and 62% even paid the full amount.

6. Distributed Denial of Service (DDoS) Attacks

In DDoS attacks, attackers flood a website with traffic and make it almost impossible for the company to differentiate between fraudulent and legitimate requests. The crashed platform is then used temporarily or even permanently to disrupt the network.

DDoS attacks usually serve as an access gateway for intruders to undertake other attacks that steal information.

7. Advanced Persistent Threats (APTs)

APTs are also malware-based attacks. However, unlike ransomware, these attacks are undertaken by a group of expert hackers. These intruders specifically target a network, gain unauthorized access to it and remain unrecognized for longer periods of time.

The major objective of APTs is to steal data rather than pose any unalterable damage to the organization.

Examples of Data Breaches and Cyber Attacks In Accounting

From small businesses to large-scale MNCs, organizations have time and again fallen victim to cyber-attacks.

Some cyber thefts make the headlines of newspapers, whereas some go unnoticed.

But all data breaches, irrespective of their impact, bring some lessons with them.

| Data breaching example | Description |

| FakeCalls Banking Trojan 2022 | Mimicked mobile banking apps in South Korea, gaining access to customer data. |

| Beanstalk Farms Cryptocurrency Theft 2022 | Stole $180 million in cryptocurrency, affecting governance and devaluing the platform. |

| AON Ransomware Attack 2022 | Ransomware attack on insurance giant AON disrupted services and damaged reputation. |

| Russian-Linked TA505 Phishing Campaign | Targeted financial institutions worldwide through email attachments and fake OneDrive sites. |

| Chqbook Breach 2020 | Leaked 2 million credit score records from an Indian fintech startup ‘Chqbook’ on the dark web. |

1. FakeCalls Banking Trojan 2022

The data breach occurred in Seoul, South Korea in April 2022. Researchers reported a malware called FakeCalls that mimicked the mobile banking apps of popular Korean banks.

This trojan imitated phone calls made to the customer service department of banks and connected them with cyber criminals. Soon upon installation, it obtained access to customers’ contacts, microphone, location and even payment data.

2. Beanstalk Farms Cryptocurrency Theft 2022

In 2022, Beanstalk lost an amount worth USD 180 million in a cryptocurrency theft. The location of this well-planned heist was the USA.

The attackers took such a huge loan that they acquired the voting rights of Beanstalk. It then made them eligible to make any governance changes they wanted to this decentralized finance platform. Since this attack, the value of each bean has reduced to near zero.

3. AON Ransomware Attack 2022

The insurance giant AON was hit by a ransomware attack in February 2022. Though it did not leave a significant impact on the company, it did result in limited disruption of several of its services.

However, AON is one of the companies that ‘insure’ insurance companies, and an attack on such a firm led to major reputational damage.

4. Russian-Linked TA505 Phishing Campaign 2021

Researchers revealed that Russian-linked TA505 targeted financial institutions all around the world in October of 2021 through a campaign named MirrorBlast. The infection penetrated into systems with the help of an email attachment.

Once clicked, it directed users to fake OneDrive sites whose goal was to evade sandboxes.

5. Chqbook Breach 2020

In December 2020, 2 million credit score records from an Indian fintech startup ‘Chqbook’ were uploaded on the dark web. The hacking group ShinyHunters allegedly conducted this leak.

The stolen data included the names, contacts, and loan details of users.

How to Combine Accounting and Cybersecurity

The most optimal way to get protection against financial fraud is by integrating advanced security protection and accounting portals.

Some of the best strategies for combining cybersecurity and accounting are:

1. IT Audits

One of the major roles of accounting teams is to perform audits of their client’s books. In addition to this, the organization should regularly audit software and hardware to identify potential security threats.

Penetration testing (which involves hacking of the system by a cyber team member) must also be deployed to identify any issues with the security framework.

2. Password Manager

Adding a complex password policy is not only beneficial for financial institutions, but other organizations can benefit from it too.

By using longer passwords, comprising numbers, alphabets and special characters, for accessing user information, accounting departments can actively manage vulnerabilities.

3. Multi-Factor Authentication

Multi-factor authentication (MFA) adds an additional layer of security to financial infrastructures.

MFA requires users to enter a password, along with an unknown factor which can be an OTP or a captcha among others. Increasing security levels can prevent malicious entities from accessing monetary data.

4. Firewall Protection

After password cracking, firewall breakdown is the most popular cyber theft in accounting.

Businesses need to implement the latest safety features such as next-generation firewalls that can detect an intruder within a few seconds.

5. User Permissions

Setting up different permission levels not only protects firewalls but also isolates the risk of fraudulent activities.

Put simply, it ensures that only specific users can view or change particular components within the system, including reports, accounts, contacts and other records.

6. Utilization of Encryption

Sophos reported that the financial services industry held the second-lowest rate of data encryption, amounting to 54% with the global average being 65%. Using encryption for financial data is necessary as it protects information from being in databases.

Additionally, encrypting sensitive emails and restricting certain users from viewing attachments ensures data safety during transmission.

Cybersecurity Best Practices for Accountants

“Prevention is better than cure”. This old saying is applicable in the modern-day accounting scenario as well. Adopting cybersecurity practices for safeguarding financial data can help an organization take control and plan ahead of cybercriminals.

The first step towards preventing data loss begins with keeping proper protection in place.

1. Understanding Threats

To come to a viable solution, accounting leaders need to understand what exactly is harming their systems. Threats can be external as well as internal. Other than cybersecurity scams, accidental data sharing with untrained staff can be equally compromising.

Accounting leaders must fully understand how data is managed in their organizations, and then create accountability in case of misplacement.

2. Financial Security Operations Implementation

FinSecOps or Financial Security Operations refers to the concept of finance, accounting and IT teams working in partnership to tackle cyber threats before they become cybercrimes.

Currently, about 43% of the total 1,100 executives surveyed by Deloitte, said that their firm’s cyber and accounting teams only worked when needed. Whereas, 11% of them admitted that the departments don’t work together at all.

Financial leaders bring with them a deep knowledge of risk management. This, when combined with the expertise of cybersecurity professionals, helps the company navigate how data is used and significantly improves decision-making.

3. Complying With Regulations

Accounting teams are supposed to adhere to several state and federal regulations. It is possible that some of the security threats are already covered in those compliances.

However, a company can only be secured from cybercrimes if it documents and incorporates those requirements into day-to-day accounting practices.

4. Regular Backups and Recovery Plans

Weekly or monthly backups ensure that all the company’s financial information is stored in a safe place. Even if the cloud storage gets hacked, backing up saves confidential information from being lost.

However, it alone isn’t enough. A company must have at hand an efficient and easy-to-deploy recovery plan in case of a data breach.

5. Employee Training

Establishing a dedicated cybersecurity accounting team is worthless if the staff doesn’t understand the magnitude of cyber risks on financial data.

To allow them to work closely with each other and use the latest technologies, employees need to be given proper training sessions. Accounting professionals must especially know how to identify cyber threats when they see one.

If you’re looking to start your career in cybersecurity, learn about the cybersecurity roadmap right here.

Nitya Saini is a tech content writer with a background of Bachelor of Science (Hons) in Computer Science. She has more than 4 years of experience in technical writing and creating resumes and SOPs.

Nitya Saini, a seasoned professional in the IT and writing domains, holds a background in Computer Science. With 2.5+ years of experience, she excels as a Content Writer and Editor.